stock here: most definitely, Hawaii is in a hard recession. Although prices are not deflating. Businesses are charging what they need to charge, at least what they think, and people in general are scared. Most see just more inflation in the future and therefore the competitive process to reduce prices, as has happened on the mainland, is not happening in Hawaii, at least not now. This is further crushing the islands.

—————————————————————————–

From Matt at Breakpoint Trades

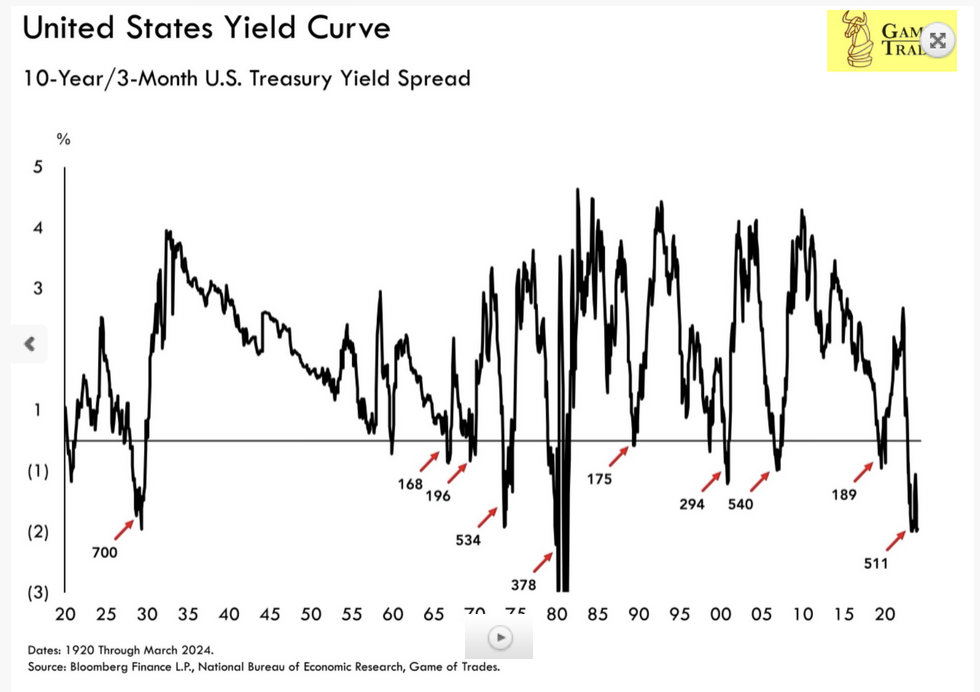

Yield Curve

Posted by matt on 21st of Apr 2024 at 11:50 am

Because we have not yet had an official recession the US Media, CNBC keeps discussing a soft landing, however I’ve always been the camp that a recession is coming, was simply delayed.

The yield curve has been inverted for over 500 days, we’ve only seen this 3 times in history:

1. 2007/2008

2. 1973/1974

3. 1927/1929

All 3 saw > 50% stock market drawdowns

Hopefully things don’t have to go through one of those major corrections/hard times like back then, but it would not surprise me, we all know something bad is eventually coming.

please give an expansive description of the yield curve inversion and the psychological processes that accompany it

ChatGPT

A yield curve inversion is a significant event in the financial markets that occurs when short-term interest rates are higher than long-term interest rates. In other words, it’s when the yield curve, which typically slopes upwards from shorter-term to longer-term maturities, flips and slopes downwards. This inversion of the yield curve is often interpreted as a warning sign of an impending economic recession.

Here’s an expansive description of the yield curve inversion and the psychological processes that accompany it:

- Yield Curve Basics:

- The yield curve is a graphical representation of the relationship between the yields (interest rates) and the time to maturity of bonds of the same credit quality but different maturities. Normally, longer-term bonds have higher yields to compensate investors for the added risk of holding the bond for a longer period.

- Inversion Dynamics:

- Yield curve inversions typically occur when investors become pessimistic about the economy’s future prospects. When economic uncertainty rises, demand for long-term bonds increases, pushing their prices higher and their yields lower. Conversely, short-term rates may remain steady or rise due to central bank actions or expectations of near-term economic tightening.

- This inversion can occur due to various factors, including expectations of future interest rate cuts by central banks, concerns about economic growth slowing down, or fears of an impending recession.

- Psychological Processes:

- Risk Aversion: Investors become increasingly risk-averse when they anticipate economic troubles ahead. They seek the safety of long-term bonds, driving their prices up and yields down.

- Expectations of Economic Downturn: A yield curve inversion reflects widespread beliefs among investors that economic growth will slow down or even contract in the future. This pessimism can become self-reinforcing as investors adjust their behavior based on these expectations, potentially leading to a downturn.

- Anxiety and Uncertainty: Yield curve inversions often trigger anxiety and uncertainty among investors, policymakers, and the general public. There’s a fear of the unknown, as an inverted yield curve has historically been a reliable predictor of recessions.

- Loss Aversion: Investors may also fear potential losses in the stock market or other riskier assets if a recession materializes. This fear can drive them to sell stocks and move into safer investments, exacerbating market volatility.

- Confirmation Bias: Once a yield curve inversion occurs, investors and analysts may search for further evidence to confirm their beliefs about an impending recession. This can lead to a self-reinforcing cycle of negative sentiment and market behavior.

- Market Impact:

- Yield curve inversions can have significant impacts on financial markets. They often lead to stock market sell-offs, as investors reevaluate their risk exposure and adjust their portfolios accordingly. Additionally, they can influence central bank policies, with central banks potentially cutting interest rates to stimulate economic growth and counteract the recessionary pressures signaled by the inversion.

In summary, a yield curve inversion represents more than just an esoteric financial phenomenon; it’s a reflection of broader economic sentiment and can have profound psychological effects on market participants. It serves as a warning sign of potential economic trouble ahead, triggering anxiety, uncertainty, and shifts in investor behavior that can further influence market dynamics.